Governor of California

Job Description

California voters are looking for a highly organized go-getter to serve as our state’s next chief executive. This is a four-year contract position with the possibility of a one-time extension.

As governor, this employee will supervise more than a quarter-million state employees, command the National Guard, write an annual budget proposal exceeding $180 billion, and probably serve as the only state politician that most Californians know by name.

Qualifications

- Ability to cajole, flatter, and goad 120 stubborn assembly members and senators into advancing a policy agenda.

- Familiarity with the following issues: how to prepare for the next recession, how to manage the state’s burgeoning pension liabilities, whether to support bail reform, whether to support a state-run, single-payer health insurance program, how to respond to possible cuts in federal Medicaid spending, how to increase transparency and close achievement gaps in public education, how to encourage more housing development, whether to stick with the current governor’s climate change policies, and how to prepare for next year’s fire season. Among other things.

- Oratory skills sufficient to give an annual “State of the State” speech

- Required: Know enough qualified people to fill positions at 457 offices, boards, and agencies. These include the Department of Finance (which helps write the budget and provides fiscal advice), the Environmental Protection Agency (which regulates water use, toxic substances, and runs the state cap-and-trade program for greenhouse gases), the Health and Human Services Agency (which runs Medi-Cal and the state’s welfare programs), and the Department of Corrections and Rehabilitation

- Preferred: Understand what those offices, boards, and agencies actually do

- Willingness to accept credit for state policy successes—deserved or not

- Willingness to accept blame for state policy failures—deserved or not

- Perks:

A flexible schedule: The governor will have the option to call special sessions of the Legislature to take up the special causes.

A blue pencil with which to cross out particular expenses the Legislature thinks the state should pay for, but the governor doesn’t.

While the previous 38 holders of this office have been men (37 of them white, except for roughly 10 months in 1875), technically, we are an equal opportunity employer.

Hiring Update

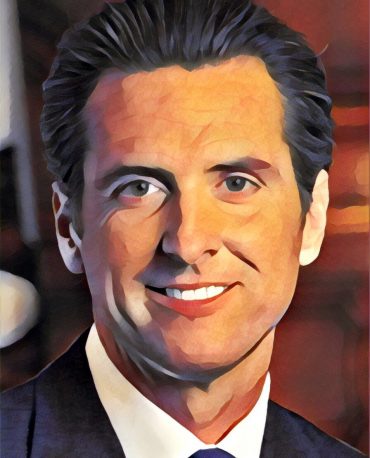

And then there were two. After a raucous first round of interviews with nearly 30 applicants, the hiring committee has narrowed the field down to Gavin Newsom and John Cox.

Newsom, the current lieutenant governor, remains the strongest applicant by virtue of the fact that he consistently comes first in the polls, has raised the most money, and most Californians actually know who he is. He’s also a Democrat. John Cox, a Republican businessman who has never held office, says that he is the best candidate to “clean the barn” (think “drain the swamp,” but purpose-built for Sacramento’s cowtown image). He also has the backing of President Donald Trump. That seal of approval helped him get this far but it may prove to be a liability with most voters.

Compare Applicants

Create a Side-by-Side-Comparison

- California Dream

- Education

- Environment

- Healthcare

- Housing

- Justice

- Taxes & Budget

- Transportation