Qualifications

Job duties include:

- Certify insurance agents and brokers in the state

- Investigate consumer complaints

- Approve premium rate increases when financially necessary, even though voters tend to really, really not like that

- Make sure insurance companies have enough money set aside in the event of catastrophe

- Spend a lot of time worrying about what the full repeal of Obamacare, the next wildfire season, and the San Andreas fault will do to the California insurance market

No background in insurance law required! (Actually, if any applicants have that, it would be a first for the office.)

Hiring Update

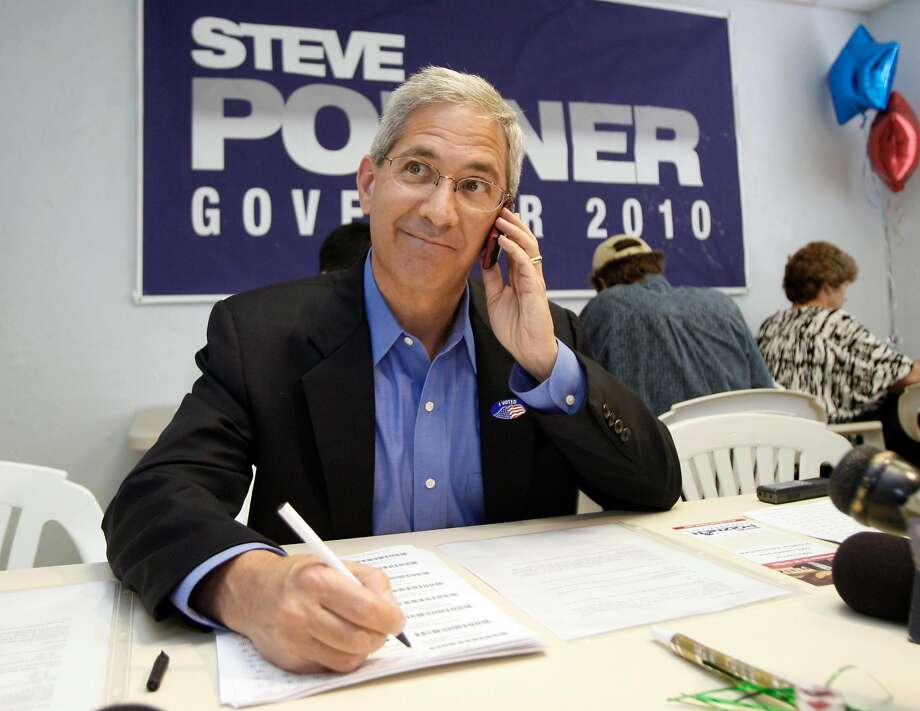

Steve Poizner is trying to get his old job back while state Sen. Ricardo Lara is vying to keep the seat in Democratic hands.

Poizner, a longtime Republican who recently changed his party affiliation and is running as an independent, was the state insurance commissioner from 2006 to 2010. He is touting his experience as critical to help underinsured homeowners and fight health insurance premium increases.

For his part, Lara is asking voters to look at his record in the state Legislature on health issues, including his advocacy of health care for immigrant children and a single-payer health care system.

Contributions to candidates for Insurance Commissioner

Create a Side-by-Side-Comparison

1

Click or tap the dropdown to choose the issue you want to see the candidate's stances on.

How do you plan to ensure that California homeowners are protected from wildfire?

Steve Poizner:

He plans to launch a “broad-scale education campaign” to educate homeowners about the need for proper coverage and about the insurance products available. He also vows to push for tighter transparency regulations on policies, so that homeowners exactly know what kind of coverage they’re purchasing. He also plans to use the “bully pulpit” of the office to call for forest thinning.

Ricardo Lara:

He argues for stronger disclosure requirements, so that homeowners know exactly what kind of insurance that they are purchasing.

Should homeowners who live in areas with high-fire risk be required to pay more for insurance?

Steve Poizner:

Yes. He says charging homeowners “according to risk” is both more fair (because low-risk homeowners don’t have to pay more) and encourages people to “make the right decisions.”

Ricardo Lara:

Yes. “The rest of California shouldn’t subsidize” homeowners in high-risk areas. He also says the state should “look at” local land use decisions that allow for development into the wildland-urban interface.

How should the state insurance market prepare for rising sea-levels?

Steve Poizner:

He says he is “very concerned” about how rising sea-levels will affect property along the state’s coastline. As insurance commissioner, he says he would look into approving new insurance plans that offer discounts for engaging in environmentally-friendly behavior. “I would be looking for other kinds of incentives that I could put in place.” He says he is “intrigued by” but undecided on the effort by current commissioner Dave Jones to force insurance companies to divest from the coal industry.

Ricardo Lara:

He says the prospect of higher sea-levels is “one of the most critical issues that the insurance industry has to be part of.” He points to Senate Bill 30, a bill he authored which has been signed into law, that requires the Department of Insurance to form a working group to recommend new insurance plans that promote investment in “natural infrastructure” to reduce the risks of climate change, such as wetlands. He says he supports current efforts by current commissioner Dave Jones to force insurance companies to divest from the coal industry.

Do you support a single-payer health insurance system in which the state provides coverage to all Californians?

Steve Poizner:

No. He says adopting such a system would be too expensive and legally infeasible. “Single payer is not the answer...I think there’s a lot we can do to improve the Affordable Care Act.”

Ricardo Lara:

Yes. He says a single payer system is the best way to ensure that all Californians have access not just to coverage, but to high-quality care as well. “I’m not saying it’s going to be overnight, but it’s a laudable goal that we should have and that we should work towards.”

Health insurance regulation is currently split up between the Department of Insurance (run by the insurance commissioner) and the Department of Managed Health Care (who director is appointed by the governor). Should all health insurance regulation be under one roof?

Steve Poizner:

Yes. He says the “fragmented regulatory structure” makes things more confusing for consumers and allows insurance companies to “game” the system. He has no preference about which regulator take responsibility for the market, as long as there is only one.

Ricardo Lara:

Yes. “In my opinion it should fall (under) the Insurance Commissioner.” But he acknowledges that this might be politically unrealistic.

by Joe Garofoli, San Francisco Chronicle

Story

by Dan Morain, CALmatters

Story

by Vauhini Vara, California Sunday Magazine

Editorial

by Editorial Board, The Mercury News

Story

by Trudy Ring, The Advocate

Story

by Casey Tolan, The Mercury News

Editorial

by Los Angeles Times